Could the BRICS Common Currency and its Impact on the Gold Market Take Gold to $10,000?

Click here to schedule your free appointment with one of our experts

In an interview with Willem Middelkoop, Founder and CIO of the Commodity Discovery Fund and KitCo, a leading gold producer, he said that the BRICS finance ministers and central banks have been instructed to look into a common currency and make it a priority for the next summit in 2024. This is a significant development, as it could lead to the creation of a new global currency that could rival the US dollar.

Middlekoop believes that the creation of a BRICS common currency would be a major boost for the gold market. Gold is seen as a safe haven asset and would likely become even more popular if it were used as a reserve currency. He expects a very strong move in gold and silver in the next 5 to 10 years.

"You can also look at the ratio between gold and the amount of fiat money in circulation," he said. "We've seen gold readjust and revalue much higher … in the 1930s, in the 1970s, and between 2000 and 2011."

"So once gold starts to run, and especially in a reevaluation scenario, it will go up 5x, 8x, 10x. So expect gold to move to $10,000."

The creation of a BRICS common currency and the rise in the price of gold are two closely related developments. The BRICS countries are all major gold producers, and they have been accumulating gold reserves in recent years. This is a way for them to reduce their reliance on the US dollar, which is losing its status as the world's reserve currency.

The BRICS common currency would be backed by gold, which would give it stability and credibility. This would make it a more attractive option for international trade and investment than the US dollar, which is becoming increasingly volatile.

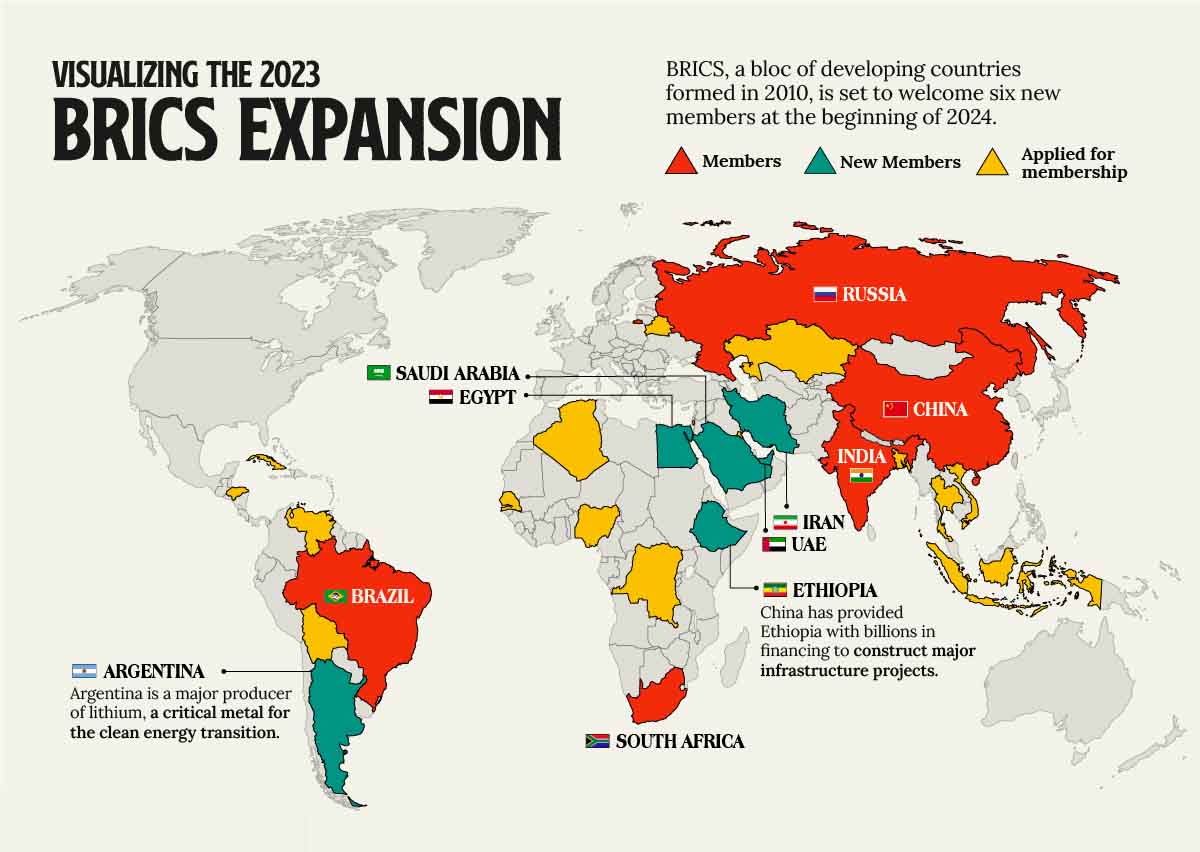

This map shows the current, new and prospective BRICS member countries

image courtesy of Visual Capitalist

The creation of a BRICS common currency would be a major challenge, but it is something that the BRICS countries are committed to doing. They believe that it is necessary to create a more stable and equitable global financial system.

Here are some of the factors that could contribute to the rise in the price of gold if a BRICS common currency is created:

- The BRICS countries would be more likely to use gold as a reserve currency, which would increase demand for gold.

- The BRICS common currency would be backed by gold, which would make it more stable and credible than the US dollar.

- The US dollar would be less attractive as a reserve currency, which would also increase demand for gold.

- The global economy would be more unstable, which would make gold a more attractive investment.

It is impossible to predict with certainty what will happen to the price of gold in the future, however, the creation of a BRICS common currency and the rise in the price of gold are two developments that could have a significant impact on the global economy.

BSC Collectibles offers a variety of tax-free gold solutions. Our products are VAT-free on purchase and capital gains tax-free upon sale, making them a wholly tax free way to protect and grow your wealth. We offer a wide range of gold products and our team of experts who can help you choose the right product for your needs and budget.

To learn more about our tax-free gold solutions, please schedule a no-obligation chat with one of our experts. We would be happy to discuss the current market, forecasts, and the wide range of products we offer.

Click here to schedule your free appointment with one of our experts